Insurance

Term life insurance offers several benefits, including:

1. Affordability: Term life insurance is generally less expensive than permanent life insurance.

2. Flexibility: Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years).

3. Death benefit: Pays a death benefit to beneficiaries if the policyholder dies during the term.

4. Income replacement: Helps replace income and maintain living standards for dependents.

5. Mortgage protection: Can be used to pay off outstanding mortgage balances.

6. Funeral expenses: Can help cover funeral costs.

7. Business protection: Can be used to protect business partners, employees, or key personnel.

8. Convertibility: Many term life insurance policies can be converted to permanent life insurance.

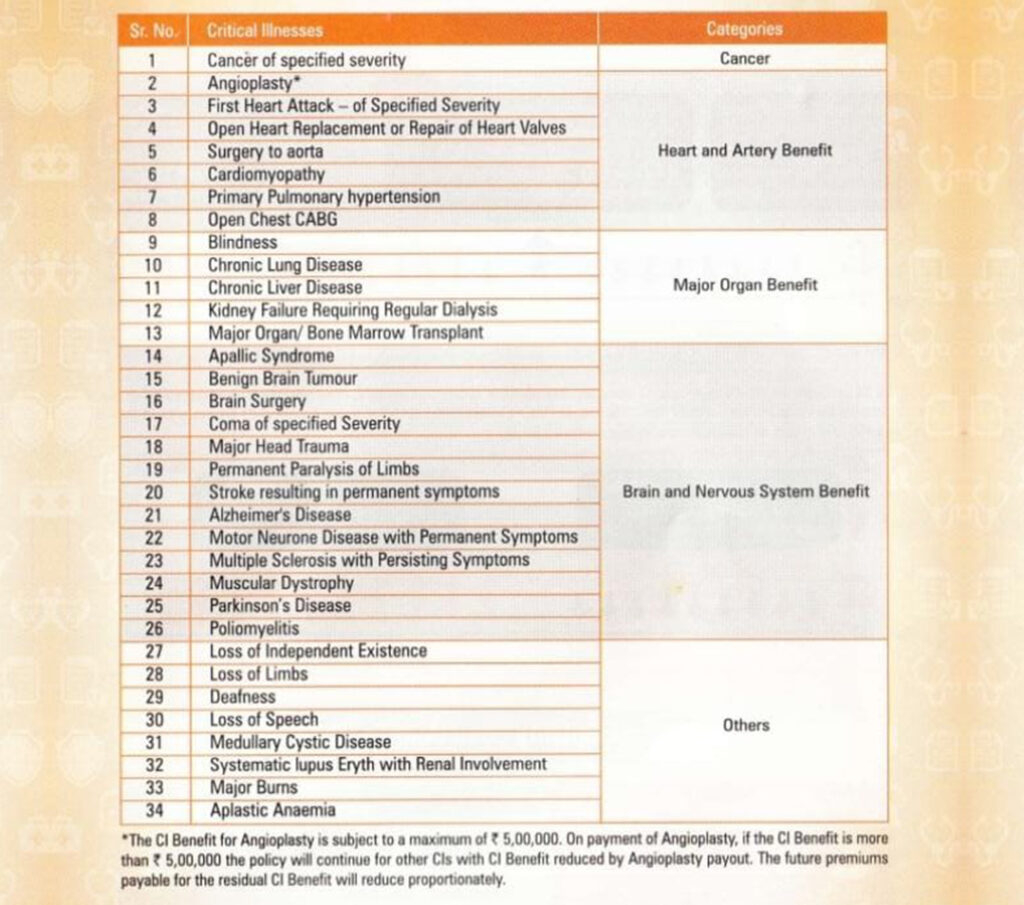

9. Riders and add-ons: Additional features like critical illness rider, accidental death benefit, waiver of premium, or long-term care riders can be added.

10. Tax-free benefits: Death benefits are generally tax-free to beneficiaries.

11. Peace of mind: Provides financial security and peace of mind for policyholders and their loved ones.

Term life insurance is a suitable option for individuals with temporary financial obligations or those who need affordable coverage for a specific period.

Critical Illnesses Covered

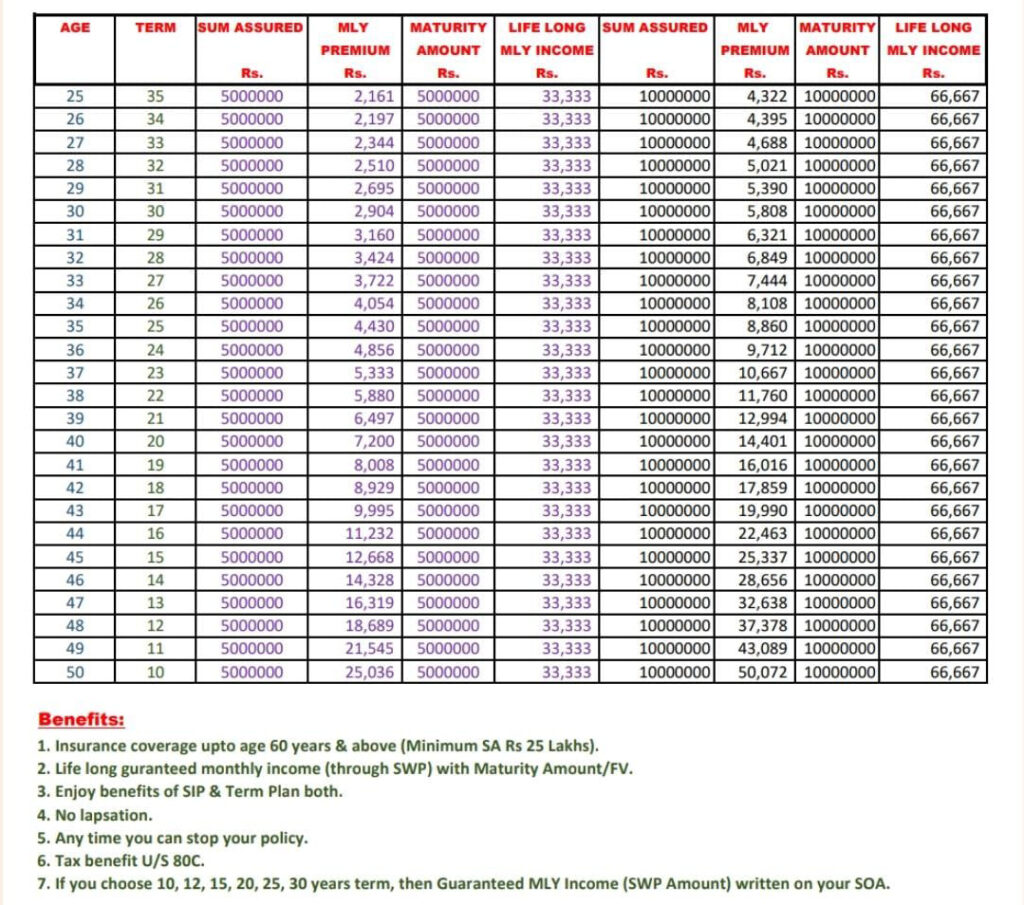

With Profit Term Plan

The plan is designed based on some certain assumptions.

Post your Queries?

If you have any queries regarding life insurance, mutual fund, critical illness policy, demat account opening, health insurance, personal accident insurance policy, etc.