Mutual Funds

What is a Mutual Fund?

Mutual funds are diversified investment vehicles that pool money from many investors to invest in various financial instruments. Here are the primary types of mutual funds:

By Investment Objective:

1. Growth Funds: Focus on capital appreciation.

2. Income Funds: Emphasize regular income generation.

3. Balanced Funds: Combine growth and income.

4. Liquid Funds: Invest in short-term debt instruments.

5. Tax-Saving Funds: Offer tax benefits.

By Asset Class:

1. Equity Funds: Invest in stocks.

2. Debt Funds: Invest in bonds, debentures, and other debt instruments.

3. Hybrid Funds: Combine equity and debt.

4. Commodity Funds: Invest in gold, oil, etc.

5. Real Estate Funds: Invest in property.

By Investment Style:

1. Active Funds: Fund managers actively manage the portfolio.

2. Passive Funds: Track a specific market index.

3. Sector Funds: Focus on specific industries (e.g., tech, healthcare).

4. Theme-based Funds: Invest in emerging trends (e.g., sustainability).

5. Index Funds: Track a specific market index.

By Risk Level:

1. Low-Risk Funds: Liquid funds, debt funds.

2. Moderate-Risk Funds: Balanced funds, hybrid funds.

3. High-Risk Funds: Equity funds, sector funds.

Other Types:

1. Exchange-Traded Funds (ETFs): Trade on stock exchanges.

2. Closed-Ended Funds: Have a fixed tenure.

3. Open-Ended Funds: Allow continuous investment and redemption.

4. Interval Funds: Combine features of open-ended and closed-ended funds.

When selecting a mutual fund, consider factors such as:

1. Investment goals

2. Risk tolerance

3. Time horizon

4. Fund performance

Consult a financial advisor to determine the best mutual fund strategy for your individual needs.

Mr. Raamdeo Agarwal & Mr. Ajay Tyagihas prefers Mutual Funds over Stocks for Reatil Investors

MYTH: Mutual Funds are only for those who like to invest in stock market

FACT: Mutual Funds (MFs) are vehicles for investment but not confined to the stock market alone. MFs also invest in money market & debt market instruments Treasury Bills, Govt Securities, Certificate of Deposits, Commercial Papers and Corporate Bonds etc. The benefits in investing through MFs are that the investments and associated risks are managed professionally by fund managers, backed by a team of analysts. Also by investing in Mutual Funds one is not worried to track the various sectors and companies and their growth prospects. The investor is not required to take the call when to buy or sell the shares. Further, the investor gets the benefit of diversification. For e.g., a diversified equity fund would invest across a number of stocks which would not have been otherwise possible if the individual investor were to invest directly in stocks.

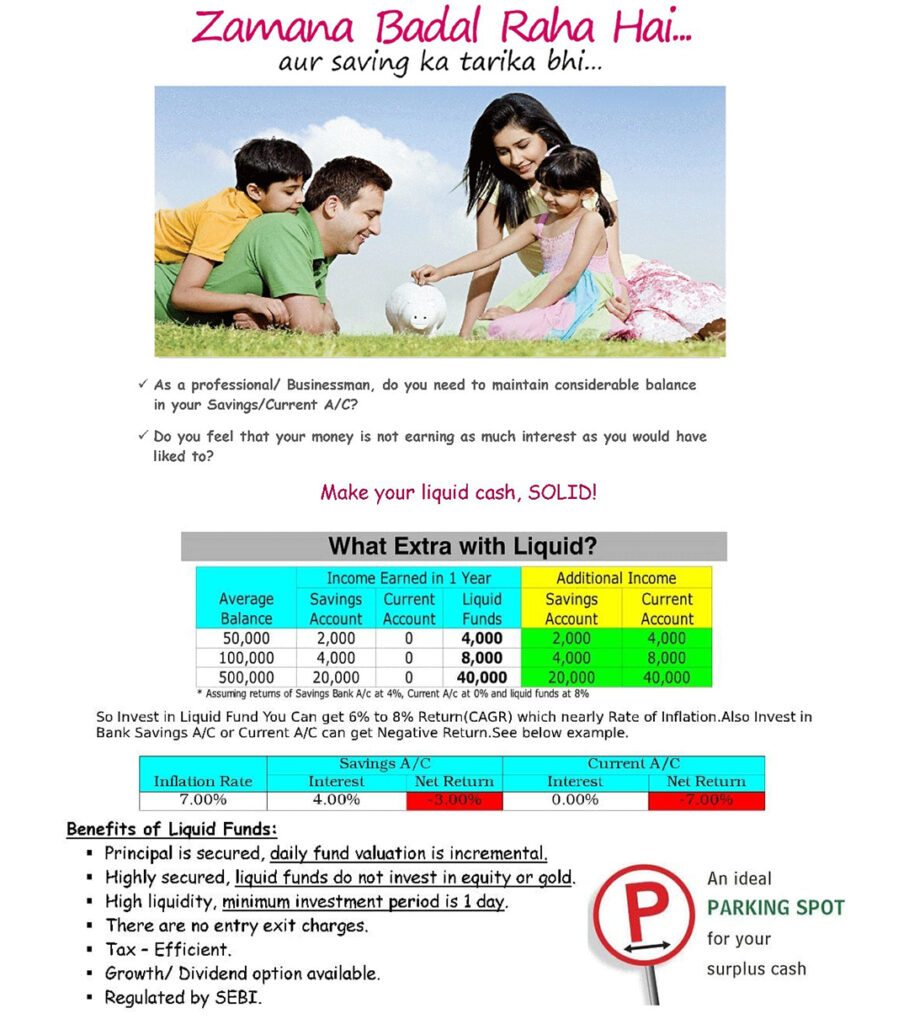

Zamana Badal Raha Hai

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Post your Queries?

If you have any queries regarding life insurance, mutual fund, critical illness policy, demat account opening, health insurance, personal accident insurance policy, etc.